If you told me at the end of 2024 that Boston’s real estate market would start 2025 with this much energy - and confusion - I probably would’ve raised an eyebrow. But here we are, six months into the year, and the landscape has shifted in fascinating ways. As someone who’s spent the first half of 2025 walking triple-deckers in Dorchester, prepping listings in JP, and working with nervous first-time buyers in Somerville, I’ve had a front-row seat to this evolving market.

Let’s break down what’s really happening with single-family homes, multifamily investments, and apartment rentals in Boston - and what that might mean for buyers, sellers, and investors heading into the second half of the year.

🔑 Single-Family Homes: Low Inventory, High Emotions

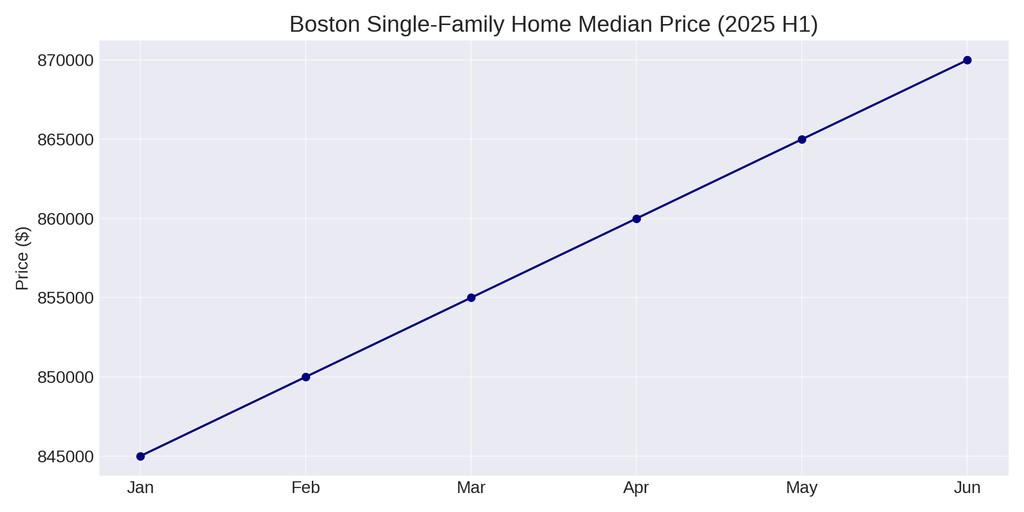

Boston’s single-family home market remains tight - a theme we’ve now lived with for several years. Through June 2025, the median sale price for a single-family home in Boston hit $861,000, up about 4.1% compared to the same time last year. But here's the twist: demand has outpaced inventory in almost every neighborhood.

In Roslindale and West Roxbury, I’ve personally seen three or four offers per home still happening, especially under the $1 million mark. One young couple I worked with in May had to write five offers before finally landing a 3-bed colonial in Hyde Park.

On the flip side, higher interest rates - hovering around 6.6% to 6.8% in Q2 - have made monthly payments feel heavy. That’s cooled some of the frenzy, but not enough to shift the balance. Sellers who price correctly still sell within 18-21 days on average.

👉 Buyer Tip: Get your financing lined up early, and don’t hesitate on well-priced homes.

👉 Seller Tip: Even with high prices, presentation matters. The best-staged homes sell for 3-5% above asking.

🏢 Multifamily Market: Investors Are Picky, But Still Present

As someone who’s worked with multiple small-scale and mid-size investors this year, I’ve noticed a shift. The multifamily space is quieter-but not dead. Investors are still looking, but they’re more cautious, more numbers-driven, and much less willing to “take a chance” on underperforming properties.

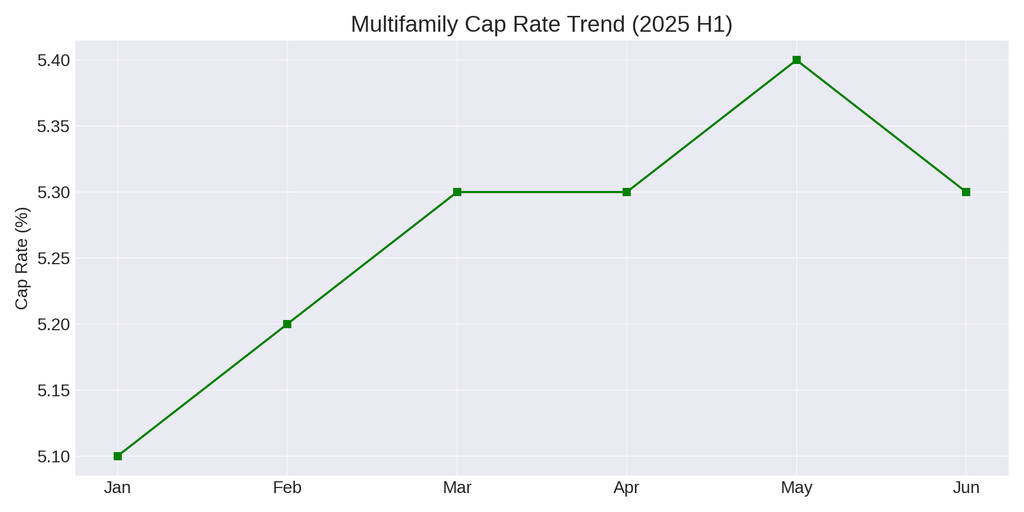

So far in 2025, the average cap rate in Boston proper has hovered around 5.3%, a modest increase due to both rising rents and slightly softer purchase prices. East Boston and Dorchester continue to attract buyer interest due to their relative affordability and rent growth. But I’ve also seen more buyers walk away during due diligence if the numbers don’t make sense.

Multifamily sales volume is down around 9% compared to the first half of 2024, but serious buyers are targeting 3-6 unit properties they can partially owner-occupy or reposition for higher yield.

Regulatory uncertainty (especially around rent control conversations at the state level) is making some hesitant, but not enough to completely pull out of the market.

👉 Investor Insight: The value-add play is still strong, but underwriting has to be razor-sharp.

🏙️ Apartments & Rental Market: Plateau or Just Pausing?

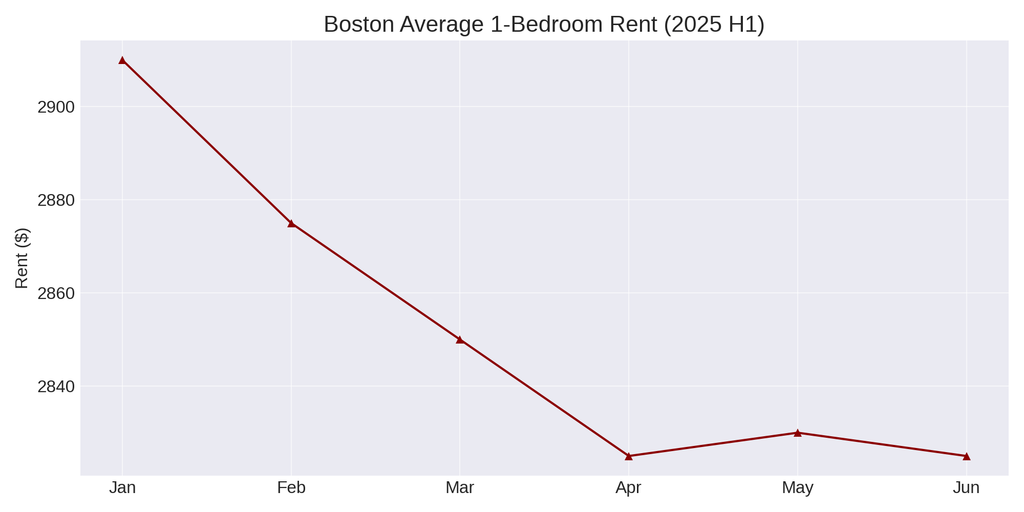

After several years of strong post-pandemic rent growth, Boston’s apartment market has started to level off-but not collapse. The average rent for a 1-bedroom apartment citywide is $2,825, down slightly from a Q4 2024 peak of $2,910. Vacancy rates crept up to 4.1%, but that’s still relatively low by urban standards.

Luxury units in Seaport and Back Bay have seen the biggest price softening, while mid-tier rentals in Brighton, Allston, and Dorchester remain in high demand. I've had rental clients struggle to find decent places under $2,500 that aren’t snatched up within days.

Landlords are adjusting. Many are offering one month free, upgraded amenities, or flexible lease terms to stay competitive. But make no mistake: Boston remains a landlord’s town overall.

👉 Renter Tip: If you're flexible on location, neighborhoods like Mattapan and Eastie are offering better deals than they did a year ago.

📈 Outlook for the Rest of 2025

So, what’s next?

Barring any macroeconomic surprises (we’re watching inflation and the Fed closely), I expect the Boston housing market to stay resilient through the rest of the year. Buyers may get more leverage if rates stay high, but limited inventory will keep prices from dropping dramatically. Sellers will need to be strategic, and investors will continue playing the long game.

For me, the first half of 2025 has been all about managing expectations-whether you're trying to find a dream home in JP or secure a triple-decker with strong upside. The market isn’t crashing. It’s evolving. And if you're clear on your goals, there’s opportunity here.

Let’s keep our eyes on the next six months. And as always, if you want to talk strategy-buying, selling, or investing-drop me a line. I’m Paolo Jimenez, and I’ve got boots on the ground in Boston every day.

__________________________________________________________________________________________________________

Real Estate Advisor

857-424-0141

Email: [email protected]

Website: paolojrealestate.com

__________________________________________________________________________________________________________

📌 Disclaimer

The information provided in this blog post is based on publicly available market data, personal experience, and general observations as of June 2025. While I strive to present accurate and timely insights, real estate markets can change rapidly, and outcomes may vary based on individual circumstances. This content is for informational purposes only and should not be considered financial, legal, or investment advice. Readers are encouraged to consult with a licensed real estate professional or financial advisor before making any real estate decisions.

__________________________________________________________________________________________________________

Boston single-family homes for sale, Best Boston suburbs for families 2025, Luxury homes in Boston MA, Historic homes for sale Boston, South End Boston single-family homes, Brookline MA homes for sale, Cambridge MA single-family homes, Newton MA luxury real estate, Charlestown Boston houses for sale, Jamaica Plain homes for sale, Boston multi-family homes for sale, Best Boston neighborhoods for real estate investors, Triple-decker homes Boston, Dorchester MA investment properties, Roxbury multi-family homes, Boston real estate cash flow properties, Somerville MA duplex for sale, Allston-Brighton rental properties, Boston fixer-upper homes for sale, High ROI Boston real estate, Boston apartments for rent 2025, Luxury condos Boston Seaport, Downtown Boston high-rise condos, Best Boston neighborhoods for young professionals, Fenway apartments for rent, Back Bay condos for sale, Affordable apartments in Boston, Boston waterfront condos, South Boston luxury rentals, Pet-friendly apartments Boston, Best Boston real estate agents 2025, Top-rated Boston realtors for first-time buyers, Boston housing market forecast 2025, Is now a good time to buy in Boston?, Boston real estate closing costs, How to sell a house fast in Boston, Boston real estate attorney recommendations, Boston home inspection companies, Boston mortgage lenders with low rates, Boston real estate tax deductions, Cheap homes for sale near Boston under $500K, Boston real estate with parking, Walkable neighborhoods in Boston, Best Boston schools and homes for sale, Boston townhouses with roof decks, New construction homes Boston 2025, Boston short-term rental laws, Off-market Boston real estate deals, Boston home staging tips for sellers, How to invest in Boston real estate with no money

Leave a Reply