Why East Boston Remains a Hot Market

East Boston's housing market has always had its own rhythm, and 2025 is no exception. Remember when places here would sell in hours? Well, things have settled a bit - but don't think that means it's gotten any easier. The skyline views still steal the show in every listing, but now there's more to the story. Prices aren't shooting up like rockets anymore (thank goodness), but try finding a decent place that lasts more than a few days on the market. Between the tight inventory and all those new buildings going up, it's still a competitive scene.

Here's what's really happening with East Boston real estate this year:

- First-time buyers are facing fewer crazy bids (but still plenty of competition)

- Investors are eyeing those new developments near the Blue Line

- Renters are seeing slight relief after years of increases

Whether you're looking to buy, invest, or just understand the neighborhood's changes, I'll break down the real trends - no sugarcoating, just straight talk about where Eastie's market is headed in 2025.

Pricing Trends: Slower Growth, But Still Rising

📊 Price Check: Still Going Up (Just Not as Fast)

What this really means:

✔️ Prices are still climbing, just not at the "hold onto your wallet" 5-7% rates we saw during COVID

✔️ Waterfront luxury condos (those $1M+ ones) are basically bullet proof - they're not losing value

✔️ Mortgage rates are still making everything feel expensive

My Take:

"Good homes still get multiple offers, but buyers aren't panic-bidding $100K over asking anymore. My advice? Move quick when you see something right, but don't get caught up in bidding war drama."

Bottom Line:

Eastie's still hot, just not scorching. If you're buying, you've got more breathing room than 2021 - but don't expect any steals. Renters? The slight slowdown might mean smaller annual increases (emphasis on might).

(Source: MLS PIN, January-May 2025 data)

The Home Search Struggle is Real

Why you can't find anything good:

- Everyone's staying put (3% mortgage rates = golden handcuffs)

- New buildings? Mostly fancy condos (RIP affordable three-deckers)

- Investors won't sell (Rents are too damn good)

My tip:

"Saw a decent place in Eagle Hill last week that needed work - only 4 offers instead of the usual 10. That's your sweet spot."

Who's Actually Buying These Days?

The 4 Types of People at Open Houses:

- First-timers (40%) - Frantic couples with Zillow alerts set to "$750k max"

- Investors (30%) - That guy in the BMW checking rental math on his phone

- Luxury buyers (20%) - Empty nesters pointing at yachts from condo windows

- Downsizers (10%) - Former suburbanites who realized shoveling sucks

Where the Action Is:

📍 Jeffries Point - Where every sale starts with "This 1890s charm..."

📍 Eagle Hill - The "I can almost afford this" zone

📍 Waterfront - For when you need a lobby attendant more than a 401k

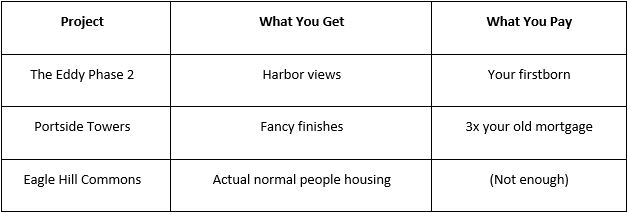

What's Being Built (And Why It Matters)

Coming Soon:

- That Red-Blue Line connector we've been promised since 1995

- Flood walls (climate change is coming for your basement)

My investor to see:

"Pre-construction condos = future profits. Eagle Hill three-deckers = Friday night pizza money."

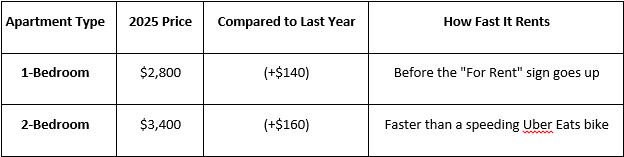

Renting in Eastie? Buckle Up

Landlord Problems:

- Airbnb rules tighter than airport security

- That rent control debate that won't die

Pro Tip:

"Multi-families near Maverick = always rented. Just don't be a slumlord."

SO...SHOULD YOU BUY HERE?

Good Reasons:

- Blue Line access will always be king

- Waterfront property isn't getting cheaper

- Basically zero chance of prices crashing

Bad Reasons:

- Hoping to flip for quick profit (those days are gone)

- Expecting suburban space (lol)

- Can't handle construction noise (we don't sleep here)

Final Thought:

"Eastie's not the steal it was in 2015, but it's still the smartest bet in Boston proper. Just come in with realistic expectations."

YOUR NEXT STEPS

For Buyers: Get pre-approved yesterday. Compromise on that "perfect" kitchen.

For Sellers: Price it right or become that stale listing everyone ignores.

For Investors: Think cash flow, not just appreciation.

Need help? I'm available - no salesy BS, just straight talk.

📞 Call/text me at 857-424-0141

📧 Email: [email protected]

🔍 Website: paolojrealestate.com

PS - If you see me at Angela's Cafe, the espresso's on me. Let's gossip about that weird house on Princeton Street.

TopRealtorInBoston FindAHomeinBoston BestplacestoinvestinBoston SingleFamilyHomeinBoston ApartmentforRentinBoston WheretoliveinBoston Bostonrealestatenews Bostonrealestatemarket Findmearealtor BostonLifestyle Bostonbestplacestolive InvestinBoston Bostonrealties BestrealtorsinBoston budgetfriendlyhomesinboston Boston southendhomes westendhomes bostonsuburbs realestatemarketboston bostonhomes bostonrealty

______________________________________________________________________________________________________

FAQs

- What are the current trends in the East Boston real estate market as we approach 2025?

It’s a weird mix of ‘slowdown’ and ‘still crazy.’ Prices aren’t skyrocketing like 2021, but good luck finding a decent place under $700K. Everyone wants to be near the Blue Line, inventory’s tighter than a packed Maverick Square train at 8am, and those waterfront condo towers? Basically printing money for developers.

- How have housing prices in East Boston changed over the past few years, and what can we expect by 2025?

Remember when a 3-bedroom in Jeffries Point was 600K? Now it’s 600K? Now it’s 850K - if you can find one. Prices jumped 20% during the pandemic madness, but 2025’s more like a 3-5% creep. The catch? Mortgage rates mean your monthly payment still feels like a punch to the gut.

- Are there any major development projects planned for East Boston that could impact the real estate market in 2025?

Oh, you mean the Portside Towers (more luxury condos we don’t need) and Eagle Hill Commons (actual affordable units—shocking!). The real game-changer? If the Red-Blue Connector ever happens. Until then, just assume every construction site is another $1,200/month studio.

- What types of properties are currently most sought after in East Boston, and how might this change by 2025?

Right now: First-timers are clawing for $750K condos, investors are hoarding three-deckers, and rich empty-nesters want ‘that one with the water view.’ By 2025? More of the same, but add ‘flood-proof’ to the wish list (thanks, climate change).

- What factors contribute to the demand for real estate in East Boston as we head into 2025?

Blue Line access (duh), that postcard skyline, and the fact you can still almost afford it compared to Seaport. Plus, all the cool restaurants and breweries make it feel less ‘up-and-coming’ and more ‘already here.

- How will transportation developments, like new transit options, affect property values in East Boston?

Both! The mythical Red-Blue Connector would make Orient Heights the new hotspot overnight. But let’s be real—until shovels hit dirt, assume your property taxes will rise faster than the T escalator at Downtown Crossing.

- What are some of the challenges facing buyers and investors in the East Boston real estate market looking towards 2025?

Buyers: Competing with all-cash offers while rates hover at ‘are you kidding me’ levels.

Investors: Navigating Airbnb bans and rent control rumors. Everyone: Praying their basement doesn’t flood during the next nor’easter.

- How is the rental market performing in East Boston, and what trends should renters anticipate by 2025?

One-bedrooms hit $2,800 this year (yes, really). Good news? The frenzy cooled slightly - landlords now get 20 applications instead of 50. Bad news? That ‘slight cool-down’ still means rent eats 40% of your paycheck.

- Are there specific neighborhoods within East Boston that are expected to see significant?

Jeffries Point if you’ve got trust fund energy, Eagle Hill for ‘I need a yard but also food stamps,’ and anywhere near Maverick Station if you enjoy your apartment renting out in 0.5 seconds. Waterfront = $$$, but resale value’s bulletproof.

________________________________________________________________________________________________________

Disclaimer

Hey, just keeping it real—this info is as current as my last espresso at Americano Coffee, but markets change faster than the weather in New England. These are my opinions based on local experience and available data, not crystal-ball guarantees. Always consult a trusted real estate pro (hi, that’s me) and a financial advisor before making moves. Prices, policies, and that Red-Blue Line connector timeline? Subject to change.

Not legal/financial advice. Past performance ≠ future results. Your mileage (and mortgage rate) may vary.

Leave a Reply